billings montana sales tax rate

Sales Tax and Use Tax Rate of Zip Code 59107 is located in Billings City Yellowstone County Montana. This is the total of state county and city sales tax rates.

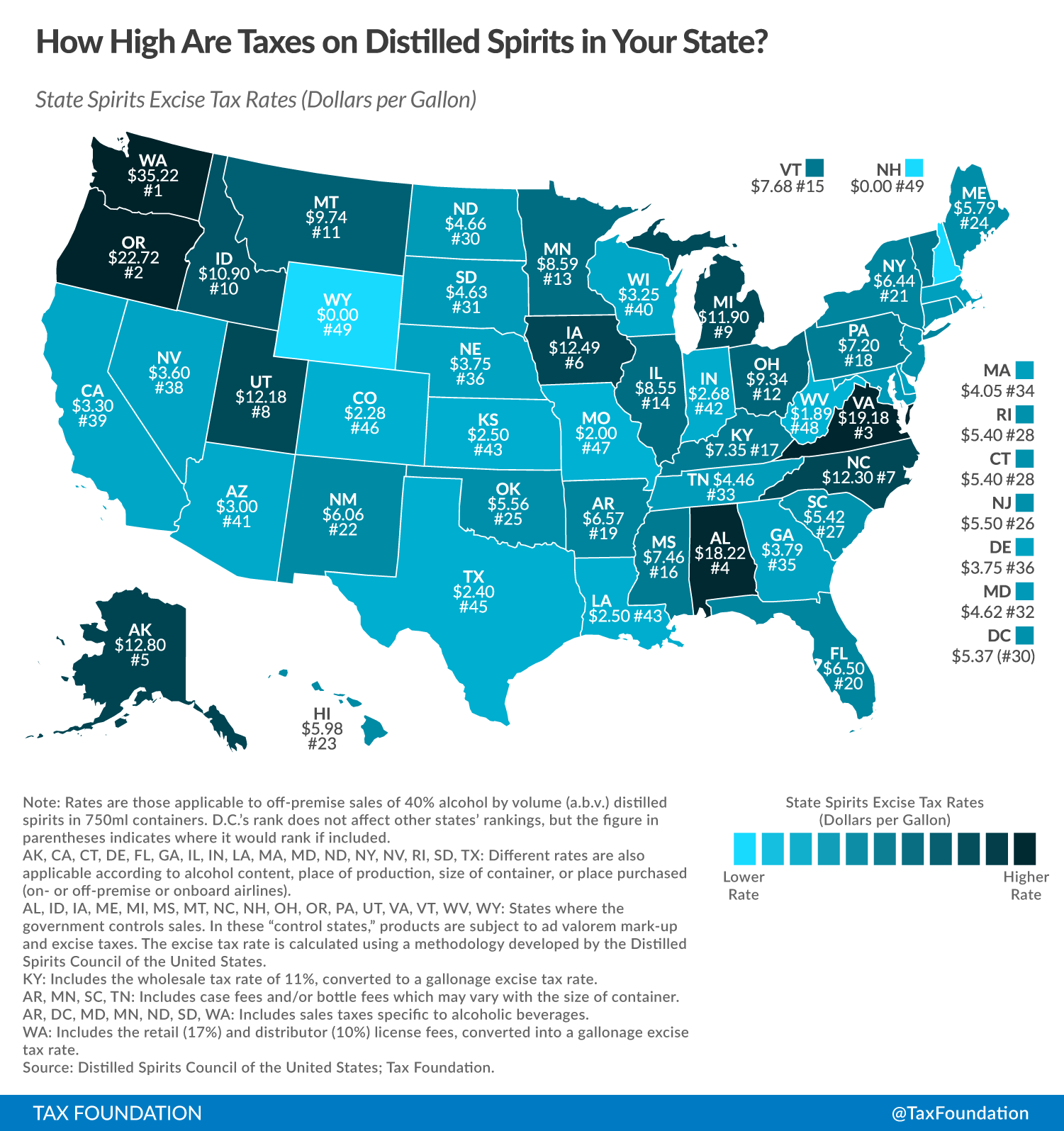

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Sales Tax and Use Tax Rate of Zip Code 59101 is located in Billings City Yellowstone County Montana State.

. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----. Billings MT Sales Tax Rate. From 2000 to 2010 Lockwood an eastern suburb saw growth of 578 the largest growth rate of any community in Montana.

Sales Tax and Use Tax Rate of Zip Code 59108 is located in Billings City Yellowstone County Montana State. Get a quick rate range. The 785 sales tax rate in Billings consists of 4225 Missouri state sales tax 175.

The Montana sales tax rate is currently. Click any locality for a full. The US average is 46.

0 State Sales tax is -----NA-----. Billings is located within Yellowstone County Montana. - Tax Rates can have a big.

0 State Sales tax is -----NA-----. This means that the state does not collect any sort of sales tax at the state or local level. 4621 Cheyenne Trl Billings MT 59106-9630 is a single-family home listed for-sale at 640000.

The Billings sales tax rate is. Montana has 0 cities counties and special districts that collect a local sales tax in addition to the Montana state sales tax. Tax rates last updated in June 2022.

The Billings Montana sales tax is NA the same as the Montana state sales tax. This includes the rates on the state county city and special levels. There is one additional tax district that applies to some areas geographically within Billings.

- The Income Tax Rate for Billings is 69. There are two additional tax. 4 rows The current total local sales tax rate in Billings MT is 0000.

Montana state sales tax rate. The US average is 73. 2022 Montana Sales Tax By County.

Bozeman MT Sales Tax Rate. 59107 zip code sales tax and use tax rate Billings Yellowstone County Montana. Home is a 4 bed 30 bath property.

The Billings sales tax rate is NA. Cost of Living Indexes. The Billings sales tax rate is 6.

The December 2020 total. Taxes in Billings Montana are 231 cheaper than Ankeny Iowa. The County sales tax rate is.

While the base rate applies statewide its only a starting point for calculating sales tax in Montana. While many other states allow counties and other localities to collect a local option sales tax Montana. The minimum combined 2022 sales tax rate for Billings Montana is.

Sales tax region name. Tax Rates for Billings - The Sales Tax Rate for Billings is 00. Billings has avoided the economic downturn that affected most of.

0 State Sales tax is -----NA-----. The average cumulative sales tax rate in Billings Montana is 0. Montana has no state sales tax and allows local governments to collect a local option.

Sales Tax and Use Tax Rate of Zip Code 59106 is located in Billings City Yellowstone County Montana State. Fortunately residents of Montana enjoy no sales tax. Base state sales tax rate 0.

Sales tax region name. Sales Tax in Billings Montana. View more property details sales history.

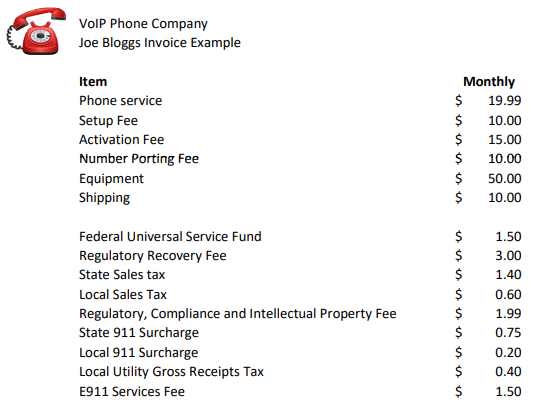

Voip Pricing Taxes And Regulatory Fees Explained

Montana Sales Tax Rates By City County 2022

North Dakota Sales Tax Rates By City County 2022

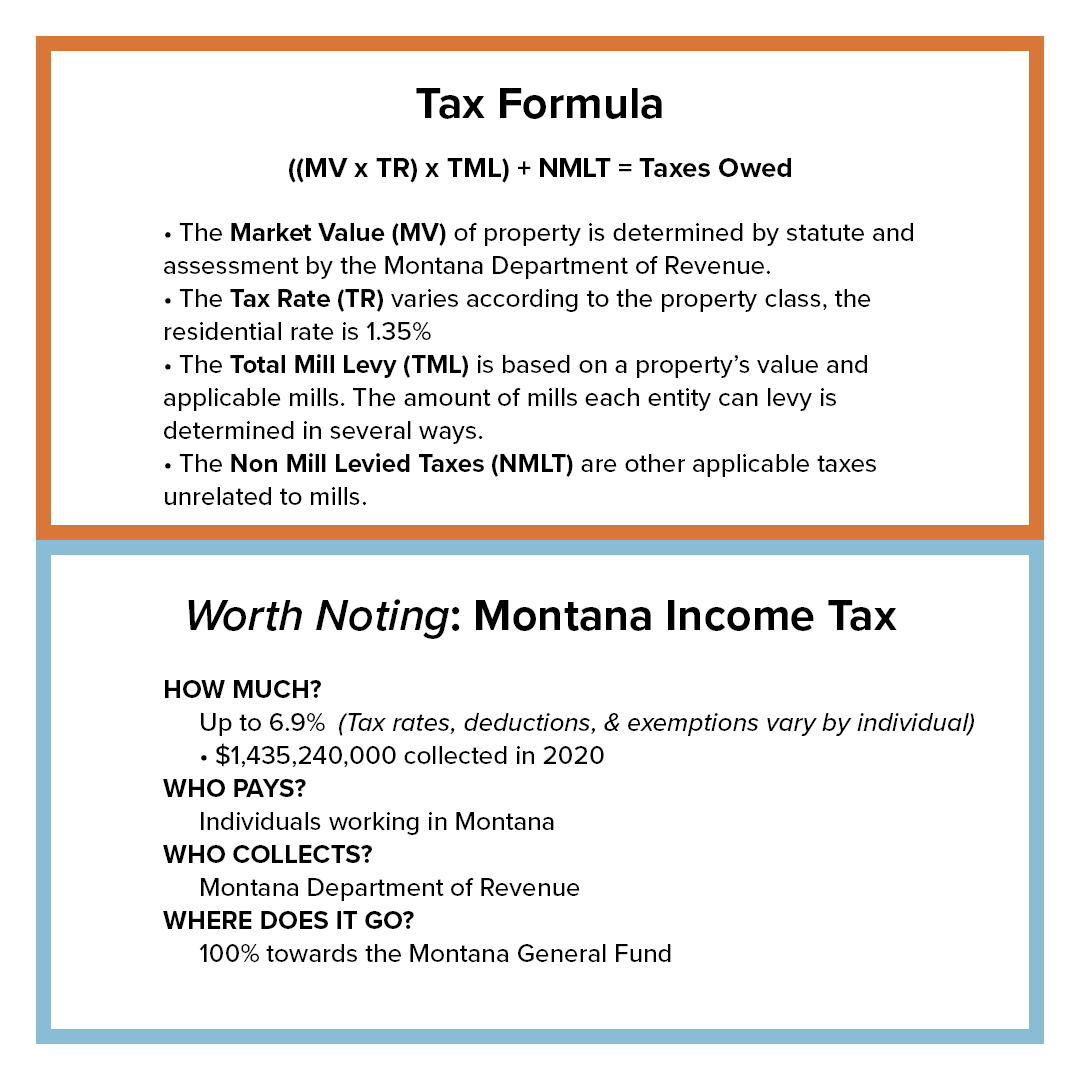

Taxes Fees Montana Department Of Revenue

Montana Retirement Tax Friendliness Smartasset

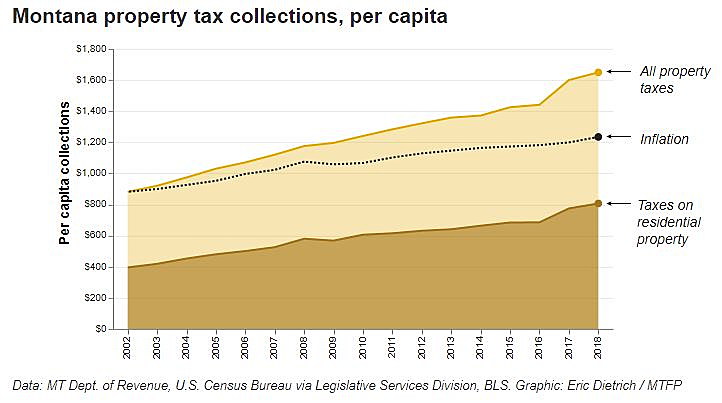

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

The 5 States With No Sales Tax The Motley Fool

Taxes Fees Montana Department Of Revenue

Ci 121 Montana S Big Property Tax Initiative Explained

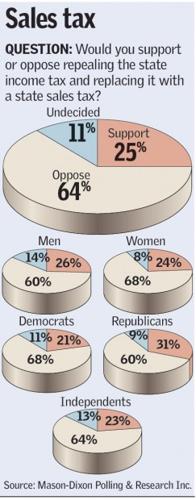

Gazette Poll Majority Says No To Banning Abortion Adding Sales Tax Montana News Billingsgazette Com

Taxes Fees Montana Department Of Revenue

Best State In America Montana Whose Tax System Is The Fairest Of Them All The Washington Post

Billings Oklahoma S Sales Tax Rate Is 6

Infastructure Phillco Economic Growth Council

Missouri Sales Tax Rates By City County 2022

District Of Columbia Sales Tax Small Business Guide Truic

Ron Drzewucki S Bullion Sales Tax Series State By State Pt 3